How Many Convenience Stores Are There in the US?

Table of Contents

Key Takeaways

-

As of 2025, the number of convenience stores in the US stands at 152,396, reflecting steady industry growth.

-

States like California, Idaho, Louisiana, Maine, and Oklahoma have expanded their convenience store presence, with California adding 177 stores in 2023.

-

The majority of convenience stores are single-store operators, particularly those with 1-10 stores, highlighting the industry's independent retail strength.

-

A significant portion of the industry is tied to fuel sales, with 16,304 stores selling fuel, reinforcing the role of gas stations in the market.

-

The NACS NIQ convenience industry data indicates continuous growth, with store expansions and evolving consumer demand shaping the convenience retailers' landscape.

Ever wondered just how many convenience stores dot the streets of the United States? With 152,255 stores currently in operation, these small but mighty retailers are a staple of daily life. Tracking the number of convenience stores in the US and their growth isn’t just trivia—it’s key to understanding shifting consumer habits, emerging markets, and economic trends. As convenience retailers expand, states like California added 177 stores in 2023, signaling steady industry growth.

Beyond just quick snacks and gas station stops, convenience stores operating in the United States play a massive role in the economy. From single store operators to big running chains, these businesses provide support for local jobs, fuel stations, and supply chains. With 16,304 stores selling fuel, they keep America moving—literally. As store counts continue to rise in states like Idaho, Louisiana, and Maine, the NACS NIQ convenience industry store data proves their undeniable impact.

Current Statistics on Convenience Stores in the U.S.

As of 2025, the number of convenience stores in the US stands at 152,255, reflecting a slight decrease of 0.1% from the previous year. However, stores selling fuel have increased to 121,852, making up nearly 80% of the total fuel sales. The convenience industry store count remains strong, with key states like Idaho, Louisiana, and Maine seeing steady numbers. These insights highlight the resilience of convenience retailers in a constantly evolving market.

The convenience industry store count includes both single-store operators and major running chains. Independents dominate by operating 66% of all stores, while large chains (500+ locations) hold 22% of the market. Smaller chains make up the remaining 12%, showing a diverse mix of convenience retailers in the game. As NACS NIQ convenience industry data demonstrates, expansion persists, with Alaska, Iowa, and Idaho increasing their overall store counts. This balance ensures consumer accessibility nationwide.

Growth Trends in Convenience Stores

Over the past decade, the U.S. convenience store industry has experienced fluctuations in store counts. In 2023, the number of convenience stores increased by 1.5% to 150,174, breaking a four-year decline. This upward trend continued into the year 2024, with the count reaching 152,396 stores, marking another 1.5% increase. However, as of January 2025, the total slightly decreased to 152,255 stores, a 0.1% dip from the previous year.

Various factors have fueled the rise of convenience stores to meet the needs of US consumers, a demand for quick and accessible shopping experiences has been quite prominent, especially amid the daily hustle and bustle lifestyle. Technological advancements, like mobile apps and self-checkout systems, have enhanced customer convenience and streamlined operations. Additionally, product diversification, including the expansion of fresh and prepared food offerings, has attracted a broader customer base seeking one-stop solutions for their needs.

Regional Distribution of Convenience Stores

As of 2025, the South Central region, particularly Texas, leads the U.S. with 16,416 convenience stores. California follows with 12,169, while Florida (9,732), New York (7,704), and Georgia (7,053) round out the top five. These states have high store counts due to large populations, highway networks, and fuel demand. The bulk of convenience stores in these regions sell fuel as well, making them essential stops for travelers and commuters.

Several factors influence the density of convenience stores across different regions. In the South Central region, the high store count is driven by a strong emphasis on fuel sales, with 72.6% of sales attributed to fuels, 21.3% to in-store merchandise, and 6.1% to food service. Urbanization and population density also play significant roles; areas with higher population densities often see more convenience stores to meet the demand for quick and accessible shopping options.

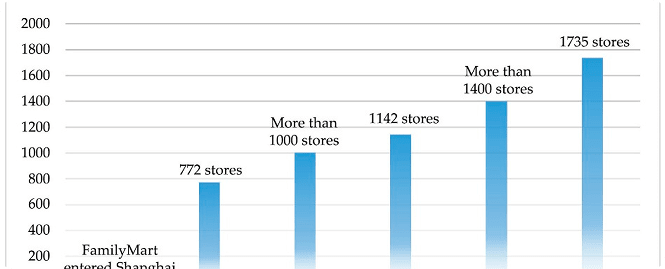

Impact of Convenience Store Chains

Major chains like 7-Eleven and Circle K significantly shape the U.S. convenience store landscape. As of 2023, 7-Eleven leads with 12,601 stores, while Circle K operates 5,845 stores nationwide. These large chains contribute to market consolidation, setting industry standards and influencing trends. Their expansive reach and resources enable them to implement innovative technologies and diverse product offerings, thereby attracting a broader customer base and impacting the overall number of convenience stores.

The U.S. convenience store industry comprises both independent operators and chain-affiliated stores. As of 2020, approximately 66% of convenience stores were independently owned, while 22% belonged to large chains that were operating in over 500 stores. This dynamic showcases the resilience of small business owners alongside the expansive influence of major chains. Independent stores can often cater to local preferences, providing personalized services, whereas chain-operated stores benefit from brand recognition and economies of scale.

Key Factors Affecting Convenience Store Growth

From shifting consumer behaviors to broader market trends, several elements contribute to the evolving landscape that shapes the industry’s expansion. Below are some key factors that drive this substantial growth:

Consumer Demand for Convenience

Modern consumers prioritize speed and accessibility, making convenience stores essential for quick purchases. With busy lifestyles and changing habits, demand for grab-and-go options continues to rise. Convenience retailers adapt by expanding product selections and enhancing services, ensuring they meet evolving customer expectations for efficiency, variety, and a seamless shopping experience.

Location and Accessibility

Convenience stores thrive in strategic locations, ensuring easy access for consumers on the go. Proximity to residential areas, highways, and urban centers enhances foot traffic. High-traffic locations drive more sales, while accessibility factors like parking, store layout, and operating hours play a crucial role in attracting and retaining loyal customers.

Technological Advancements (e.g., self-checkout, mobile apps)

Technology is transforming convenience stores, enhancing efficiency and customer experience. Self-checkout systems reduce wait times, while mobile apps enable seamless payments and personalized promotions. Innovations like AI-driven inventory management and cashless transactions improve operations, making shopping faster and more convenient for modern consumers who expect speed, ease, and digital integration.

Product Diversification (e.g., healthier options, prepared foods)

Convenience stores are now expanding beyond traditional snacks and fuel, offering healthier options, fresh meals, and specialty products to meet evolving consumer preferences. Prepared foods, organic snacks, and dietary-friendly selections attract a broader audience, while product variety enhances customer retention and competitiveness in an increasingly diverse and health-conscious market.

Competition from Other Retail Formats (e.g., supermarkets, online shopping)

Convenience stores face growing competition from supermarkets, online retailers, and delivery services offering similar products with added convenience. To stay competitive, they adapt by enhancing product variety, leveraging technology, and improving customer experience, ensuring they remain a go-to option for quick, accessible, and essential purchases in a shifting retail landscape.

Challenges Facing the Convenience Store Industry

This industry faces several challenges impacting growth and profitability. Various factors create obstacles for retailers, from consumer preferences to external market pressures. Below are some key challenges affecting the industry:

Rising Competition from Other Retail Formats

Convenience stores face intense competition from supermarkets, online retailers, and delivery services, which offer similar products with added convenience. They must adapt through product innovation, digital integration, and personalized services to stay relevant. This ensures they remain the preferred choice for quick, efficient, and accessible shopping experiences in a dynamic market.

Shifting Consumer Preferences (e.g., demand for healthier products)

Consumer preferences are evolving, with increasing demand for healthier snacks, fresh food options, and sustainable products. To attract health-conscious shoppers, convenience stores must adapt by expanding nutritious offerings, organic selections, and eco-friendly packaging. Staying aligned with these changing trends ensures continued relevance and customer loyalty in a competitive retail landscape.

Regulatory Compliance and Legal Challenges

Convenience stores must navigate complex regulations and legal requirements, including licensing, food safety standards, labor laws, and age-restricted sales. Adapting to evolving policies while maintaining compliance can be costly and time-consuming, requiring retailers to stay informed, implement proper training, and adjust operations to avoid fines, legal issues, or business disruptions.

Rising Operational Costs (e.g., labor, rent, utilities)

Increasing labor wages, rent, and utility costs pose financial challenges for convenience stores. Maintaining profitability can require strategic cost management, efficient staffing, and adoption of advanced technology. Rising expenses force retailers to optimize operations, adjust pricing, and explore automation solutions to sustain growth while keeping products affordable and accessible for customers.

Adapting to E-commerce and Online Shopping Trends

With the rise of e-commerce and online shopping, convenience stores must keep evolving to stay competitive. Implementing delivery services, mobile apps, and digital payment options will help attract tech-savvy consumers. Adapting to changing shopping behaviors ensures that convenience stores can remain relevant in an increasingly digital and on-demand retail landscape.

Future Outlook for Convenience Stores in the U.S.

The global convenience store market is projected to grow from $1 trillion in 2023 to $1.64 trillion by 2028, with a compound annual growth rate (CAGR) of 10.23%. The increasing consumer demand for quick and accessible shopping solutions drives this cumulative expansion. In the U.S., approximately 58% of convenience store operators seem to be optimistic about the business prospects that are expected in 2025, anticipating improved economic conditions and increased foot traffic.

Convenience stores are catching up to the trends and are adapting to evolving consumer preferences by embracing several key trends. There's a notable shift towards offering healthier food options, which include fresh meals and organic products, to cater to health-conscious customers. Technological advancements are also reshaping the industry; stores are implementing artificial intelligence for inventory management and personalized marketing, and electric vehicle charging stations are being introduced to meet the needs of eco-conscious consumers.

Conclusion

Convenience stores play a vital role in the U.S. economy, providing quick access to essential goods and services. Their ability to adapt to consumer demands, technological advancements, and market trends makes them indispensable. As the industry evolves, understanding its growth and challenges remains crucial for retailers and stakeholders alike.

Insurance is essential for protecting convenience store owners from unexpected financial risks. Comprehensive coverage ensures business continuity from property damage and theft to liability claims and employee-related issues. With the right insurance policy, store operators can safeguard their investments, manage risks, and maintain long-term stability in an unpredictable retail environment.